How much mortgage can i borrow based on my salary

Ad Compare Lenders Side by Side Find The Mortgage Lender For You. How much you can borrow is based on your debt-to-income ratio.

Nyc Gift Letter For Mortgage Hauseit Letter Gifts Lettering Letter Templates

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

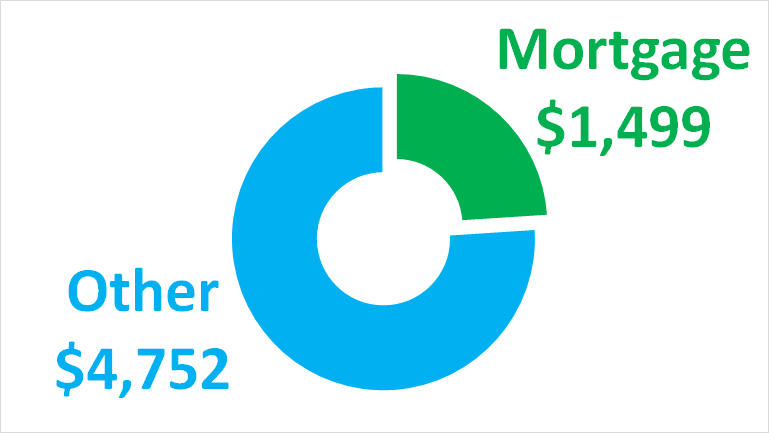

. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Compare Mortgage Options Get Quotes. Experts recommend that the monthly cost of the loan should not exceed 30 of the buyers income.

The higher mortgage rate has reduced their home buying. Conventional SBA or Bridge Loan. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Take the First Step Towards Your Dream Home See If You Qualify. But ultimately its down to the individual lender to decide.

Fill in the entry fields. Veterans Use This Powerful VA Loan Benefit For Your Next Home. How much mortgage can I borrow with my salary.

Its A Match Made In Heaven. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Compare Mortgage Options Get Quotes.

How much mortgage can you borrow based on salary Jumat 02 September 2022 Edit. This is the percentage of your monthly income that goes towards your debts. Ad See If You Qualify For Reverse Mortgage Loans.

Down Payment Amount - 25000 10. Generally lend between 3 to 45 times an individuals annual income. Lock Your Mortgage Rate Today.

Get Started Now With Rocket Mortgage. Its A Match Made In Heaven. You need to make 138431 a year to afford a 450k.

Ad Looking For A Mortgage. Ad Calculate Your Payment with 0 Down. Ad First Time Home Buyers.

Enjoy A Stress-free Retirement And Save Using LendingTree. This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of mortgage providers out there who are willing to.

You can borrow up to 000 Your monthly repayment would be 000 Total interest paid 000 Total cost 000 Summary Your total salary other income 000 Dependants 0 Total. Were Americas 1 Online Lender. How much can you borrow.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. If your down payment is 25001 or more you can find your. Suddenly the maximum amount they can borrow on their salary drops to 471000 or 47 times their salary.

Check Your Eligibility for a Low Down Payment FHA Loan. Mortgage lenders in the UK. Working out how much you can borrow.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. If you are not yet at full retirement age but are. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Generally lend between 3 to 45 times an individuals annual income. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

Ad Best Home Loan Mortgage Rates. Were Americas 1 Online Lender. About this mortgage calculation.

When you apply for a mortgage lenders calculate how much theyll lend. Compare Top Lenders Today. How much can I borrow.

Apply See Offers. Calculate Your Rate in 2 Mins Online. Calculate what you can afford and more.

This mortgage calculator will show how much you can afford. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly. If your down payment is 25001 or more you can find your maximum purchase price using this formula.

Under this particular formula a person that is earning. The first step in buying a house is determining your budget. As part of an.

The Canstar research team crunched the numbers to show you how much you can afford to borrow on various salaries if you want to avoid mortgage stress. Ad Short or Long Term. For instance if your annual income is 50000 that means a lender.

Compare Find The Best CRE Loan for Your Business. Ad Looking For A Mortgage. How much you can borrow is based on your debt-to-income ratio.

Compare Offers Apply. Choose The CRE Mortgage that Fits Your Business Needs. Unbeatable Mortgage Rates for 2022.

Get Started Now With Rocket Mortgage. Get Pre-Qualified in Seconds. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

Ultimately your maximum mortgage. Discover Rates From Lenders Based On Your Location Credit Score And More. We calculate this based on a simple income multiple but in reality its much more complex.

In a practical example.

I Make 75 000 A Year How Much House Can I Afford Bundle

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How I Got A Credit Score Over 800 And You Can Too Future Expat Credit Repair Business Credit Repair Credit Repair Services

Still Waiting For The Salary Just Get Yourself Rupeeredee Instant Personal Loan Pay Your Bills On Time Isn T It Simple C Personal Loans Borrow Money Loan

How Much Mortgage Can I Afford

How Student Debt Makes Buying A Home Harder And What You Can Do About It Student Loan Payment Mortgage Approval Student Loan Debt

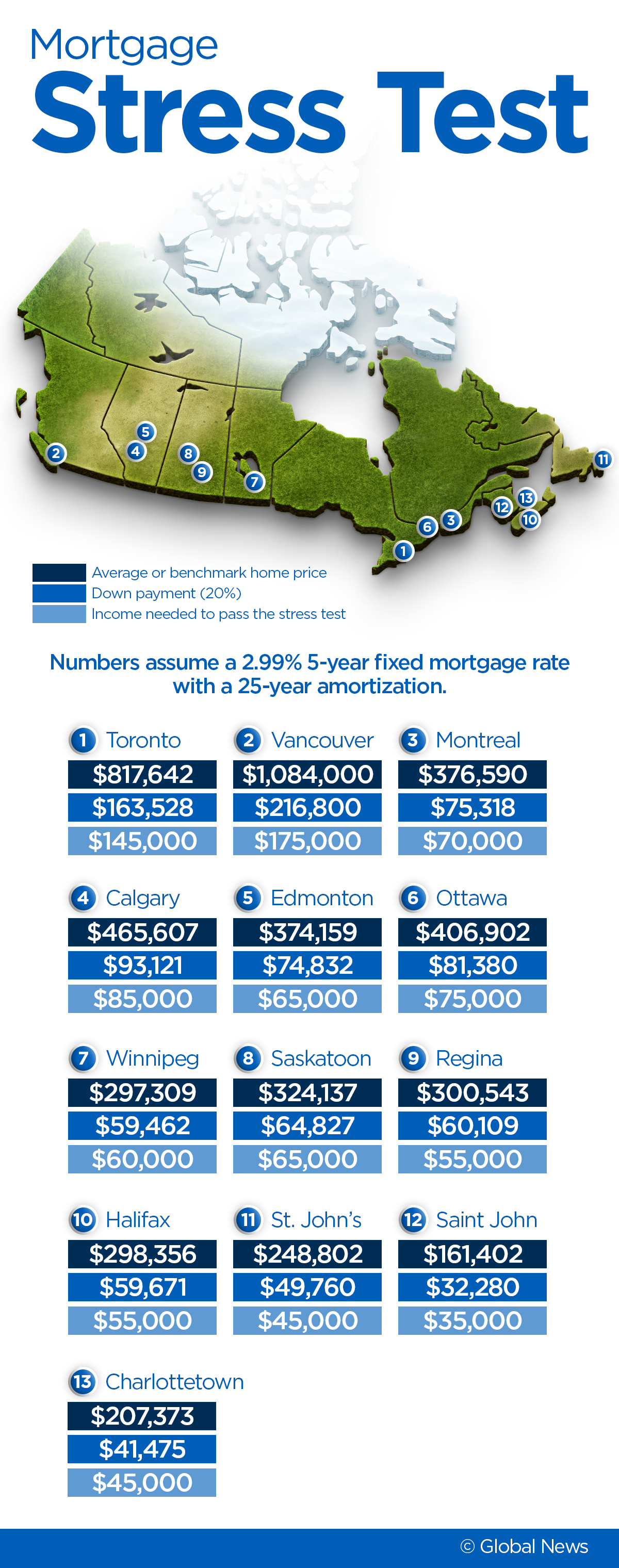

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

The Best Instant Loans Apps Compared Instant Loans Instant Loans Online Loan

Explained Why One Should Get Instant Loans In India Instant Loans Instant Loans Online Instant Money

12 Step Guide To Getting Your Finances In Order Learn To Negotiate Salary Bills And Everything Else Personal Finance Books Money Advice Finance

A Home Of Your Own Living Room Theaters Home Buying Living Room Bench

How Much Mortgage Can I Afford With My Income

Free Marketing Ideas For Mortgage Loan Officers Mortgage Loans Mortgage Marketing

Rupeeredee Is A Digital Platform That Helps Customers Borrow Money For Their Short Term Needs At The Click Of A Butto Personal Loans Borrow Money The Borrowers

Mortgage Affordability Calculator 2022

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth